rebbecatreacy

About rebbecatreacy

Understanding Personal Loans for Bad Credit: Critiques And Insights

In relation to managing funds, personal loans could be a useful gizmo for individuals looking to consolidate debt, cowl unexpected bills, or finance major purchases. However, for those with dangerous credit score, the technique of obtaining a personal loan will be daunting. This article goals to offer an in-depth understanding of personal loans for bad credit, together with how they work, the place to search out them, and reviews of various choices obtainable available in the market.

What Are Personal Loans for Bad Credit?

Personal loans for bad credit are unsecured loans provided to people with poor credit score scores, sometimes under 580. These loans are designed to help borrowers who could not qualify for traditional loans resulting from their credit score history. Lenders that offer personal loans for bad credit usually consider components beyond credit score scores, such as earnings, employment historical past, and total financial scenario.

How Do Personal Loans for Bad Credit Work?

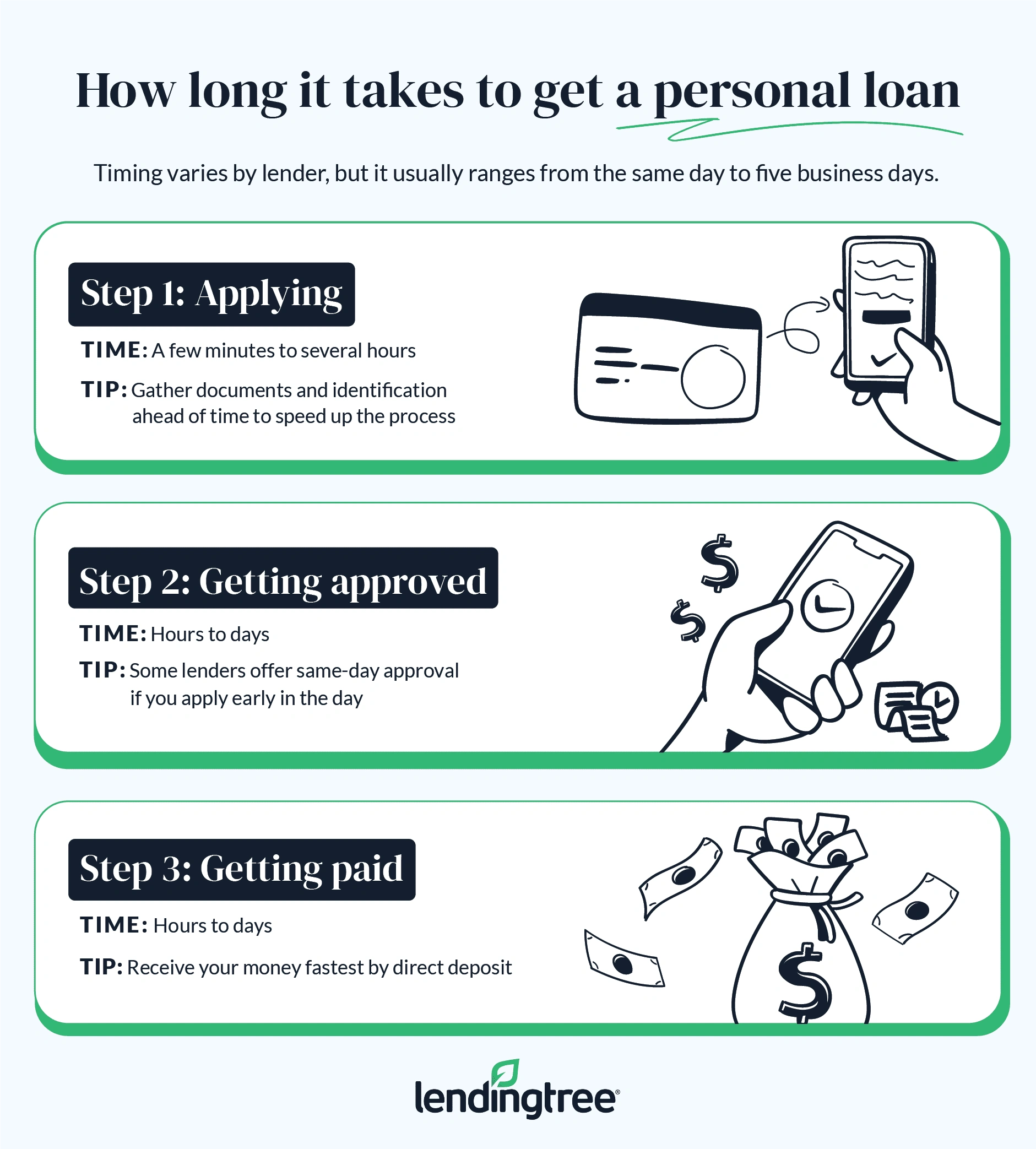

- Software Process: The application course of for personal loans for bad credit is just like that of standard loans. Borrowers fill out an application type, providing personal and monetary information. Lenders might require documentation akin to pay stubs, tax returns, and financial institution statements.

- Interest Rates: Interest rates on personal loans for bad credit tend to be higher than those for borrowers with good credit. That is because of the elevated danger that lenders take on when lending to individuals with poor credit histories. Charges can vary significantly, so it’s important to match presents from completely different lenders.

- Loan Quantities and Terms: Loan amounts can vary from a few hundred to a number of thousand dollars, depending on the lender and the borrower’s financial scenario. Terms may differ, sometimes ranging from one to 5 years. Borrowers ought to rigorously consider the repayment phrases and ensure they will handle the month-to-month payments.

- Repayment: Repayment of personal loans for bad credit usually happens in mounted monthly installments. Borrowers must adhere to the repayment schedule to keep away from additional injury to their credit scores and to forestall incurring extra fees.

Where to Find Personal Loans for Bad Credit

- Online Lenders: Many on-line lenders specialise in providing personal loans for bad credit. These lenders usually have extra versatile requirements and faster approval processes compared to traditional banks. In case you adored this article and also you would like to get more information about personalloans-badcredit.com kindly stop by the webpage. Some fashionable online lenders include Avant, Upstart, and OneMain Monetary.

- Credit Unions: Credit score unions are member-owned monetary establishments which will offer personal loans with more favorable terms for those with unhealthy credit score. They often have decrease curiosity charges and charges in comparison with traditional banks.

- Peer-to-Peer Lending: Platforms like Prosper and LendingClub join borrowers with individual buyers keen to fund loans. These platforms could consider elements past credit score scores, making them a viable possibility for those with bad credit score.

- Local Banks and Group Lenders: Some native banks and community lenders could provide personal loans for bad credit. It’s worth checking with local establishments to see if they’ve programs designed for individuals with less-than-perfect credit.

Evaluations of Personal Loans for Bad Credit

When contemplating personal loans for bad credit, it’s important to read reviews and testimonials from other borrowers. Listed below are some insights into common lenders within the area:

1. Avant

Avant is a well-known on-line lender that gives personal loans for borrowers with unhealthy credit score. They provide loans ranging from $2,000 to $35,000 with phrases of 24 to 60 months. Opinions indicate that Avant has a simple software course of and fast funding, usually within one enterprise day. Nonetheless, curiosity charges might be excessive, with some borrowers reporting APRs exceeding 30%.

2. Upstart

Upstart is one other online lending platform that makes use of artificial intelligence to evaluate borrowers’ creditworthiness. They offer loans from $1,000 to $50,000, with phrases of three or 5 years. Many users respect Upstart’s unique method, which considers factors like schooling and job historical past. Critiques spotlight a quick approval process, but some borrowers have noted that curiosity rates may be steep, notably for these with decrease credit scores.

3. OneMain Financial

OneMain Monetary has a long-standing repute for providing personal loans to individuals with dangerous credit score. They offer loans from $1,500 to $20,000, with phrases ranging from 24 to 60 months. Borrowers typically praise OneMain for their personalized service and the power to talk with a consultant in individual. Nevertheless, curiosity charges could be excessive, and some critiques mention aggressive assortment practices.

4. LendingClub

As a peer-to-peer lending platform, LendingClub permits borrowers to connect with particular person traders. They offer loans from $1,000 to $40,000, with terms of three or five years. Many borrowers respect the transparency of the platform and the ability to see a number of presents. Nonetheless, some opinions indicate that the applying process can be prolonged, and curiosity charges may vary significantly primarily based on the borrower’s credit score profile.

Tips for Securing a Personal Loan with Dangerous Credit

- Check Your Credit score Report: Before applying for a loan, overview your credit report for errors. Disputing inaccuracies can improve your credit score and increase your possibilities of approval.

- Consider a Co-Signer: If possible, having a co-signer with good credit score can increase your possibilities of approval and safe a decrease curiosity fee.

- Store Around: Don’t settle for the primary give you obtain. Evaluate rates and phrases from multiple lenders to find the very best deal.

- Improve Your Credit score: If time permits, consider taking steps to enhance your credit score rating before applying for a loan. Paying down debts and making timely payments can positively impact your credit score historical past.

- Read the High-quality Print: All the time learn the terms and conditions carefully earlier than accepting a loan. Bear in mind of any charges, penalties, and the overall value of the loan.

Conclusion

Personal loans for bad credit can provide a lot-wanted monetary relief for people going through challenging conditions. While these loans often come with higher curiosity charges and less favorable phrases, they can nonetheless be a viable option for those in want. By understanding how these loans work, where to seek out them, and what to search for in a lender, borrowers could make knowledgeable selections and take steps in the direction of bettering their monetary health.

No listing found.